The private equity industry has long been characterized by limited access to information and significant asymmetry between fund managers and investors. Fundscouter was established to address this fundamental challenge by creating the first truly independent platform for comparing private market funds, bringing transparency and objectivity to the investment selection process.

The historically opaque nature of private equity has created significant barriers for investors seeking to make informed decisions. This opacity manifests in multiple ways: limited access to performance data, complex fee structures, and difficulty obtaining standardized information across multiple fund offerings. Fundscouter was conceived in response to the growing demand for greater transparency in a market that has traditionally operated behind closed doors.

The Independent Advantage

Fundscouter's core differentiating factor lies in its commitment to independence. Unlike many platforms in the investment space that operate on commission-based models or accept placement fees, Fundscouter maintains complete objectivity by refusing payments that could influence fund rankings or analysis. This independence is not merely a philosophical position—it is essential to delivering accurate, unbiased information.

The Fundscouter platform was built on the premise that investors deserve access to comprehensive, standardized information about private market opportunities without the influence of marketing bias or sales pressure. This clarity enables more effective due diligence and decision-making across the spectrum of private equity offerings.

Our approach leverages deep expertise across private equity, fund analysis, financial technology, and data science. The Fundscouter team has developed proprietary methodologies for evaluating private market offerings, with particular emphasis on emerging structures such as evergreen funds, semi-liquid vehicles, and fund-of-funds that represent important innovations in democratizing access to alternative investments.

Evergreen Funds

Open-ended investment structures that offer greater flexibility compared to traditional closed-end funds, allowing for ongoing subscriptions and periodic redemptions.

Closed-End Funds

Traditional private equity structures with fixed terms, committed capital, and defined investment and harvesting periods.

The Fundscouter Methodology

Fundscouter employs a rigorous analytical framework that dissects private market offerings across multiple dimensions. Our fund comparison tools enable investors to evaluate various options based on standardized criteria, eliminating the information asymmetry that has traditionally benefited fund managers at the expense of investors.

The Fundscouter database encompasses over 250 funds spanning the private markets spectrum: buyout, growth equity, venture capital, private credit, real estate, and infrastructure. For each offering, we provide granular analysis of historical performance, fee structures, minimum investment requirements, and liquidity provisions—elements that are essential for making informed comparisons across different investment options.

Our analysis of funds includes examining the true risk-adjusted returns over various time horizons, assessing the comprehensive impact of fee structures (including often-overlooked costs), and providing clarity on liquidity terms—areas where marketing materials frequently lack transparency or offer only selective disclosure.

As seen on:

Market Segmentation and User Profiles

Fundscouter serves three primary market segments, each with distinct needs and use cases for the platform's capabilities:

Individual Investors

Fundscouter provides individual investors with unprecedented access to comprehensive information on private market opportunities. The platform enables comparison of minimum investment thresholds, historical returns, fee structures, and risk profiles, empowering investors to identify options that align with their portfolio objectives and risk tolerance.

Wealth Advisors

For wealth management professionals, Fundscouter provides an efficient research infrastructure, enabling rigorous analysis of alternative investment options. The platform facilitates detailed comparisons and supports the development of client-ready analysis, enhancing advisors' capacity to deliver well-informed guidance on private market allocations.

Institutional Investors

Institutional allocators leverage Fundscouter's sophisticated filtering and analytical capabilities to streamline due diligence processes. The platform enables rapid identification of funds that meet portfolio mandates, ESG criteria, and strategic objectives, significantly enhancing efficiency in the preliminary research phase.

Knowledge Infrastructure

Beyond comparative data, Fundscouter has developed a substantial educational framework to enhance investor understanding of private markets. The Knowledge Center offers comprehensive resources on private market investment structures, risk characteristics, performance metrics, and key considerations for portfolio integration.

Our educational content spans from foundational concepts to sophisticated analysis of market dynamics. The platform's video series, including "What Is Private Equity? Everything You Need to Know Before You Invest", provides accessible entry points for investors new to private markets while also offering depth for more experienced practitioners.

Analytical Framework and Methodology

Fundscouter's analytical framework incorporates multiple dimensions of fund evaluation, providing a standardized basis for comparison across different offerings:

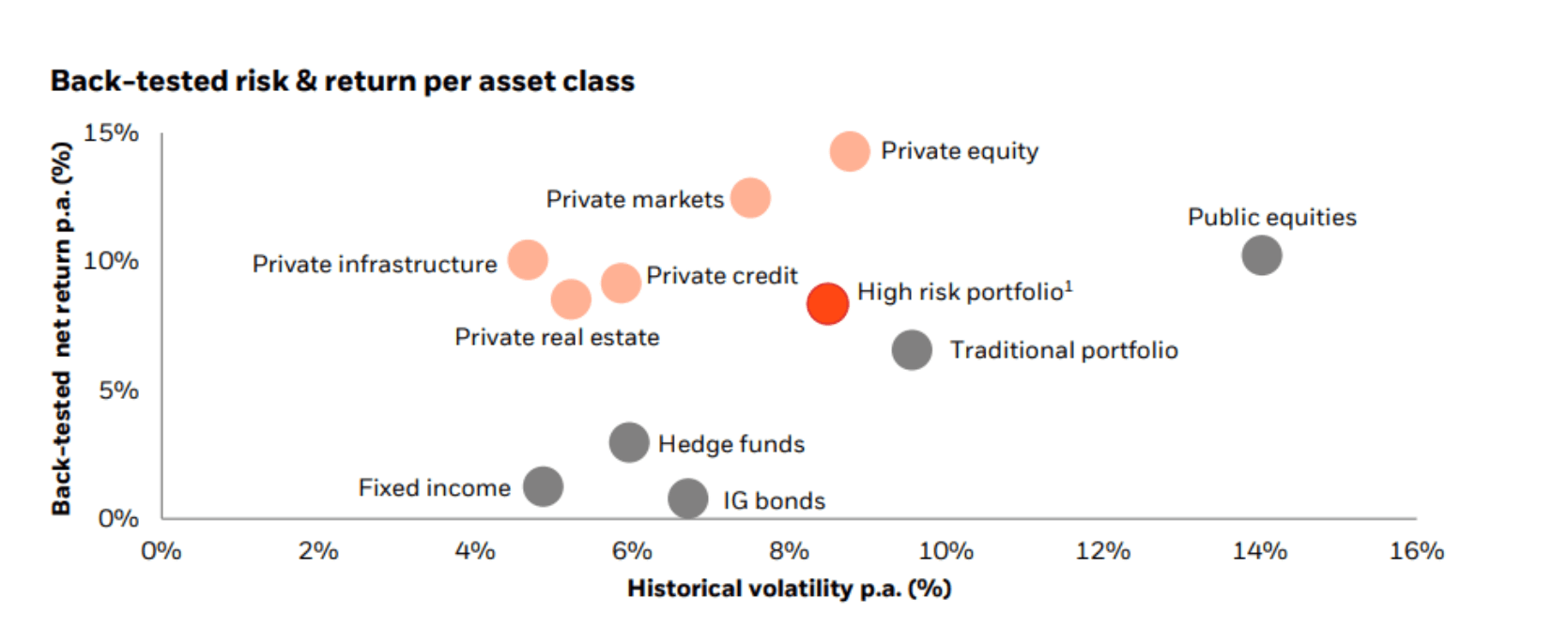

- Performance Analysis: Fundscouter evaluates historical returns across multiple time horizons and market cycles, contextualizing performance relative to appropriate benchmarks and peer groups. This analysis extends beyond headline IRR figures to include cash-on-cash multiples, public market equivalents (PMEs), and distribution metrics.

- Fee Structure Analysis: The platform provides detailed breakdowns of management fees, performance-based compensation, hurdle rates, and other cost components. This comprehensive approach reveals the true economic impact of fee structures on investor returns—an area where limited transparency has historically benefited fund managers.

- Liquidity Assessment: Fundscouter examines the full spectrum of liquidity terms, from lock-up periods and redemption windows to secondary market access and distribution schedules. This analysis is particularly valuable given the growing innovation in fund structures with varying liquidity profiles.

- Investment Strategy Analysis: The platform evaluates each fund's strategic approach, including geographic focus, sector specialization, deal sourcing methodology, and value creation mechanisms. This granular analysis helps investors match fund strategies with their portfolio objectives.

- Risk Profile Evaluation: Fundscouter provides multi-dimensional risk assessment, examining factors such as leverage usage, portfolio concentration, vintage diversification, and performance volatility. This comprehensive view enables more effective risk-adjusted return analysis.

By applying this standardized methodology across all funds, Fundscouter enables meaningful comparisons between different investment options. This consistency in evaluation is essential for investors seeking to make well-informed allocation decisions based on relevant, comparable data points rather than selective disclosures.

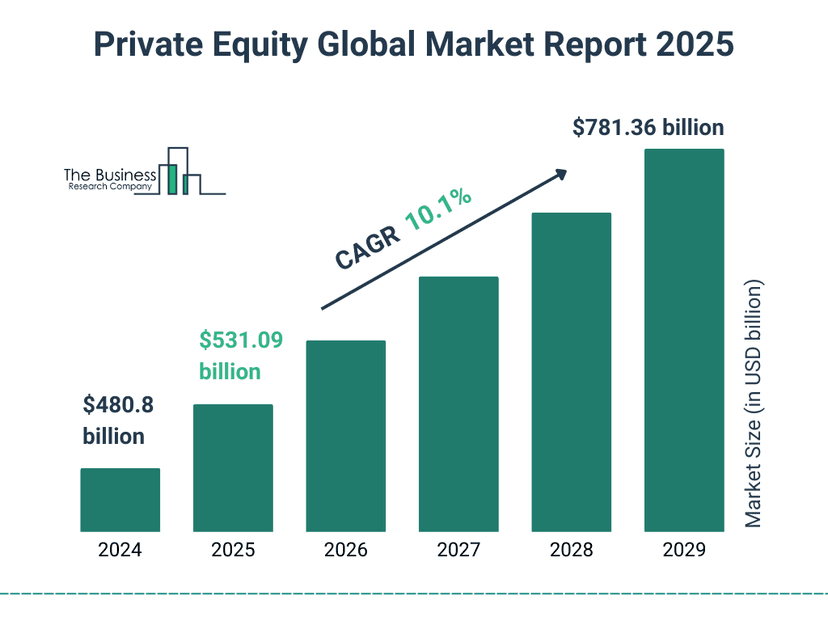

Market Evolution and Future Developments

The private markets landscape is undergoing significant transformation, with new fund structures, technological innovations, and regulatory developments reshaping the investment environment. Fundscouter remains at the forefront of these changes, continuously expanding its coverage and enhancing its analytical capabilities to reflect emerging market dynamics.

The Fundscouter blog provides regular insights on market trends, fund innovations, and investment strategies, including detailed analyses of developments such as the emergence of evergreen fund structures and broader shifts in the alternative investment landscape.

Looking ahead, Fundscouter continues to develop new analytical tools and expand its database coverage. Forthcoming platform enhancements will incorporate advanced portfolio construction capabilities, scenario analysis tools, and expanded data visualization features to further enhance the investment research process.

Engagement and Platform Access

Fundscouter invites investors at all levels of sophistication to explore the platform's capabilities and leverage its analytical tools to enhance their investment decision-making process. The comprehensive nature of the platform makes it valuable for both those new to private markets and experienced practitioners seeking deeper insights.

To begin exploring the Fundscouter platform, visit our homepage, access the fund database, or engage with our educational resources. Fundscouter actively solicits user feedback to guide platform development, ensuring that enhancements align with investor needs and market evolution.

In an investment landscape historically defined by information asymmetry and limited transparency, Fundscouter represents a fundamental shift toward greater accessibility and objectivity. By providing independent, comprehensive analysis of private market offerings, the platform enables all investors to make more informed decisions based on standardized, relevant information.

Explore Fundscouter