Among the strongest drivers in investing is compound returns. Evergreen funds have a special benefit over conventional private equity structures, in which cash stays underused for long stretches of time since they fully invest a subscription from day one. Returns so start compounding right away, hence optimising long-term value building.

Maintaining Interest vs. Dedication

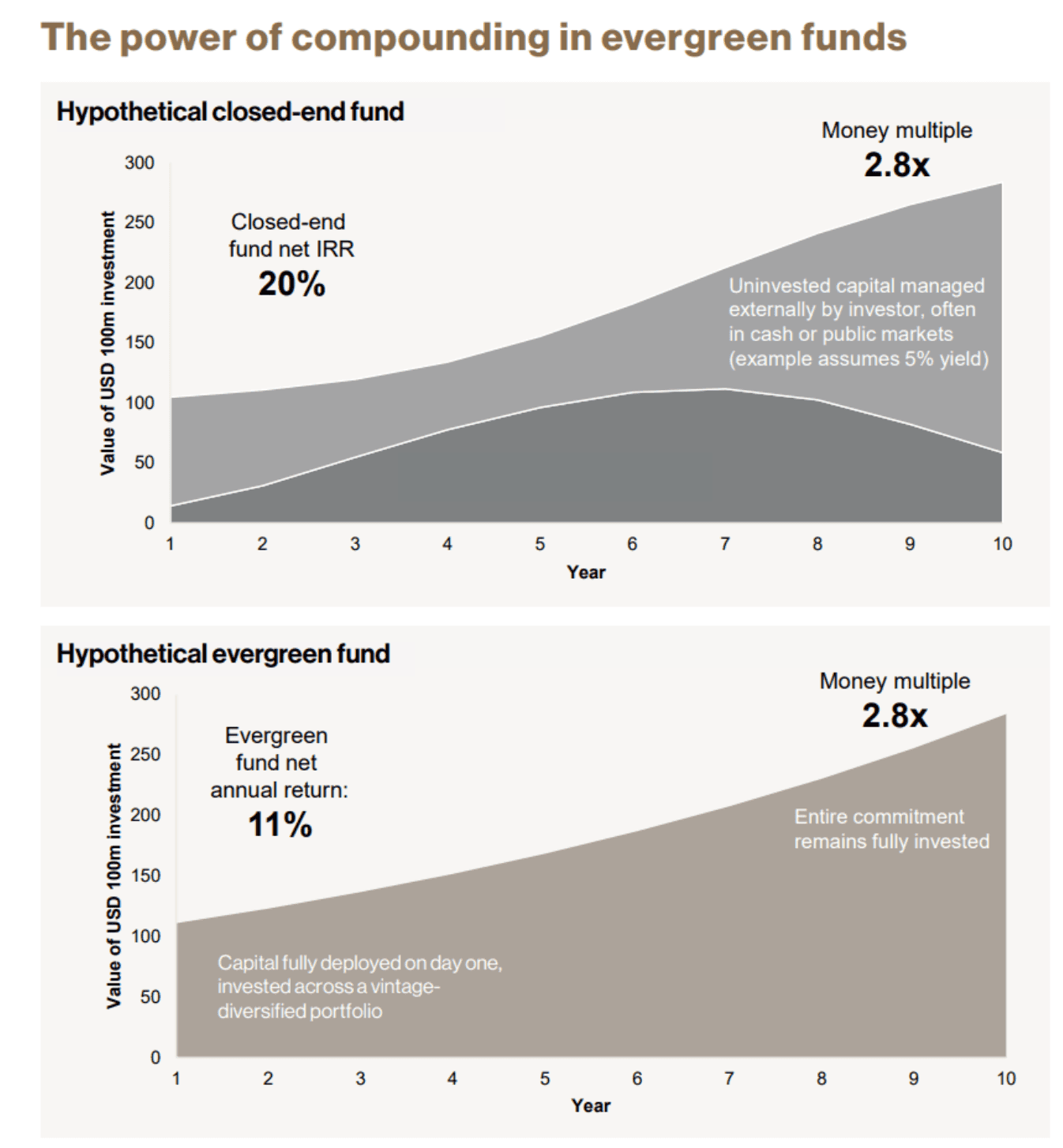

While actual deployment occurs gradually in a conventional closed-end fund, investors commit money upfront. Up to 50% of committed capital can often stay underused over the lifetime of a fund, therefore possibly reducing the overall profits produced. Even with an apparently great internal rate of return (IRR), this delay can affect the total money multiple of the investment.

Conversely, evergreen funds maintain active investment of capital. These funds fully use compounding by reinvesting returns and avoiding cash lying idle. Evergreen structures centre on maximising the actual value of invested capital instead of improving IRR by scheduling cash flows.

The power of compounding returns in evergreen fund structures

The Compounding Effect in Process

Two investing vehicles to think about are a closed-end fund and an evergreen fund. The continual reinvestment approach lets the evergreen fund perhaps reach the same or even better money multiple even if its net annual return is less than that of the closed-end vehicle. This is so because returns in an evergreen structure build without the pull of uninvested money.

Evergreen funds also offer more consistent and effective capital use by lessening the effect of undeployed resources. A better return profile and the possibility for over time wealth building help investors.

Understanding Return Metrics: IRR vs. Annualized Return

A key distinction between investment performance metrics is the difference between IRR and annualized return.

- •Annualized Return: Measures the annualized percentage gain or loss of an investment over a specific period, without considering cash flow timing.

- •IRR (Internal Rate of Return): Represents the annualized effective rate of return that equates the net present value (NPV) of all investment cash flows to zero, factoring in both the timing and scale of cash movements.

While IRR is often used to compare private equity investments, it can sometimes be misleading when assessing actual value creation. Evergreen funds, with their compounding advantage, demonstrate how staying fully invested from the outset can lead to meaningful long-term wealth generation, regardless of IRR comparisons.

In conclusion

Evergreen funds have a great benefit over conventional private equity structures in that they allow one to remain totally involved and reinvest capital continually. These funds can maximise investor value by leveraging compounding returns, therefore lowering the inefficiencies related with undeployed capital. This compounding impact may be the secret to long-term investors unlocking greater real profits across time.

Explore More