The Bow River Capital Evergreen Fund represents a pioneering approach to democratizing private equity access, offering retail and accredited investors exposure to institutional-quality private markets through an innovative semi-liquid structure. This Denver-based fund addresses a critical market need by providing the beneficial characteristics of a traditional mutual fund structure while making private investments, similar to a traditional private equity fund.

The fund operates as a first-of-its-kind hybrid structure, combining interval fund and tender offer characteristics to offer greater liquidity flexibility than traditional private equity funds. Unlike conventional PE funds that require decade-long commitments, this structure enables investors to participate in traditionally illiquid markets without committing to a decade-long lock-up, making private equity accessible to investors who have been historically shut out due to high minimums and extended illiquidity periods.

Bow River's investment strategy focuses on middle market private equity, leveraging the firm's more than two decades of experience in this space. The fund employs a diversified approach across more than 120 transactions, providing exposure to hundreds of private companies through a combination of direct investments, secondary purchases, and primary fund commitments. This multi-faceted approach allows the fund to capitalize on market inefficiencies across different transaction types while maintaining broad diversification across vintage years, geographies, and sectors.

The management team's track record speaks to their expertise in navigating challenging market environments. For the period since inception ending May 31, 2025, the Fund has generated an annualized net return of 16.88% with a maximum drawdown of 1.1%. This performance has been consistent across different market cycles, with 96% of rolling quarters showing positive returns and 100% positive returns over all 6- and 12-month periods as of March 2024. The fund's resilience during volatile periods demonstrates the value of its middle-market focus and defensive positioning strategy.

The interval fund structure provides meaningful advantages over traditional private equity access routes. Investors can redeem a portion of their holdings, typically 5–25% of the fund's net asset value (NAV), at set intervals, often quarterly, offering a middle ground between daily liquid investments and completely illiquid private funds. This semi-liquid structure prevents forced selling during market downturns while maintaining some portfolio flexibility—a critical benefit highlighted during recent market volatility when daily redemptive levered-loan funds fell victim to retail outflows and inflows over the years.

Bow River Capital brings significant institutional credibility to this retail-accessible vehicle. The Denver-based firm manages assets across five asset classes: defense technology, private credit, private equity, real estate, and software growth equity, with AUM growth from under $800M to $3B since 2019 while maintaining operational efficiency with fewer than 50 employees. The firm's strategic partnerships, including joint ventures with ONE Bow River Advisers, LLC and Thornburg Bow River Advisers, LLC, enhance their investment sourcing and due diligence capabilities.

The fund's positioning within the broader interval fund market is particularly compelling. The current market for interval and tender offer funds is approximately $175 billion in total managed assets, with funds employing venture and private equity strategies making up over $35 billion of that market. This growth reflects broader market trends toward private market democratization, with non-institutional allocations to alternatives potentially reaching $12 trillion by 2034 according to industry forecasts.

Additional Fund Details

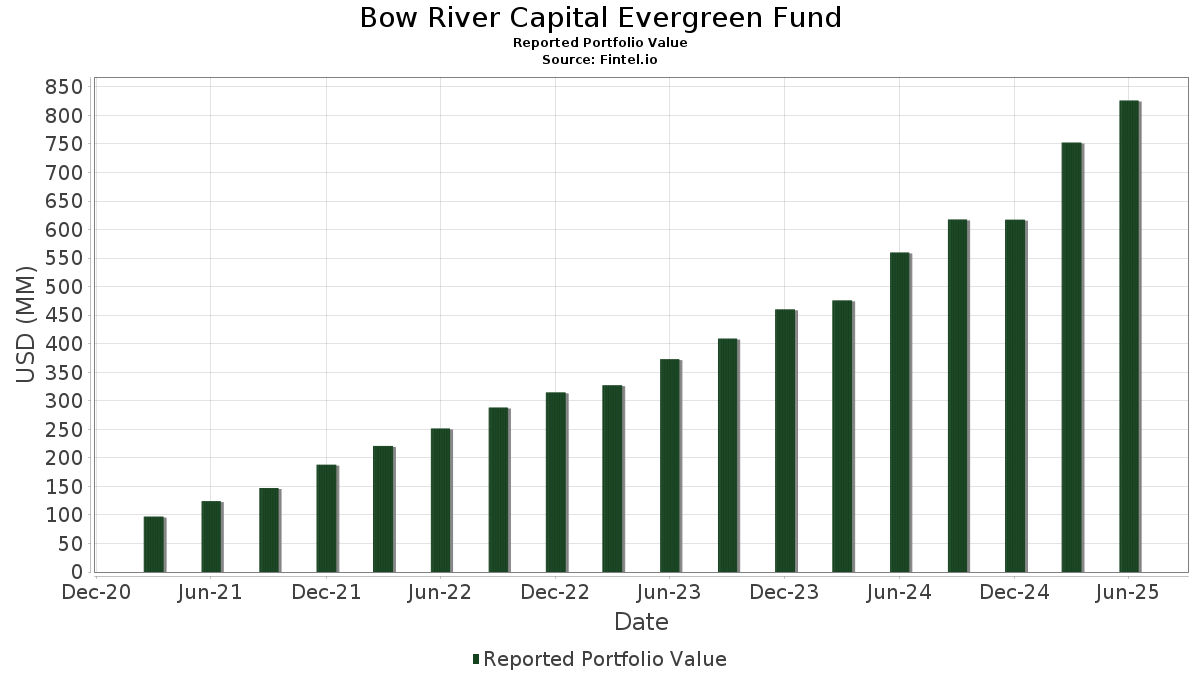

The Fund was launched in May 2020 and has experienced consistent growth, reaching $850 million in assets as of June 1, 2025 with recent expansion to nearly $990 million as of September 1, 2025. The fund offers multiple share classes with different fee structures to accommodate various investor types, and has attracted capital predominantly from family offices, wealth management firms, and individual investors.

The investment team continues to expand with recent additions including Teague Towner from the San Manuel Band of Mission Indians' Sovereign Wealth Fund and Amanda Krakauer from Blackstone, along with Erick Podwill from Canterbury Consulting and previous experience at Aksia Torrey Cove Capital Partners. The fund maintains a strategic partnership with Aksia TorreyCove Partners as a non-discretionary investment consultant, providing institutional-quality sourcing and research capabilities.

Explore more private market funds on Fundscouter.