Navigating the complex landscape of private market investments requires transparency and clarity. The Key Information Document (KID) is a crucial tool that brings structure and objectivity to your decision-making process. Understanding its components will transform you into a more confident, well-informed investor.

What is a Key Information Document (KID)?

Key Information Documents (KIDs) are standardized disclosure documents designed to help retail investors better understand investment products before committing capital. Mandated under the PRIIPs Regulation in the European Union and United Kingdom, KIDs present essential information in a consistent, accessible format.

Unlike marketing materials or fund prospectuses that can run hundreds of pages, KIDs distill the most critical information into a concise format. This standardization enables meaningful comparisons between different investment options, helping investors align choices with their financial goals and risk tolerance.

Important KID Components

Risk Indicator (SRI)

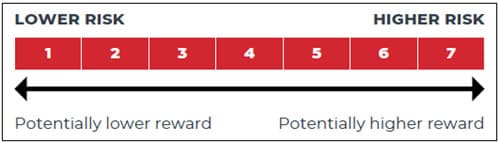

The Summary Risk Indicator (SRI) is perhaps the most visually striking element of a KID. Using a scale from 1 to 7, it provides an at-a-glance assessment of the relative risk associated with an investment product. A rating of 1 represents the lowest risk category, while 7 indicates the highest risk.

This numerical representation allows investors to quickly gauge risk levels and compare them across different funds. At FundScouter, we believe understanding a fund's risk profile is the cornerstone of making informed investment decisions.

Performance Scenarios

KIDs include several performance scenarios showing how an investment might perform under different market conditions. These typically include:

- Favorable scenario: Representing optimistic market conditions

- Moderate scenario: Showing expected performance under normal market circumstances

- Unfavorable scenario: Illustrating below-average conditions

- Stress scenario: Demonstrating performance during severe market downturns

These projections help set realistic expectations and enable investors to prepare for various market environments. They offer a more balanced view than traditional marketing materials that might focus primarily on best-case scenarios.

Costs

Understanding the cost structure is essential for evaluating an investment's potential returns. The KID breaks down costs into three categories:

- One-off costs: Entry and exit fees

- Ongoing costs: Management fees, operating expenses, and other recurring charges

- Incidental costs: Performance-based fees and carried interest

FundScouter's comparison tools emphasize fee transparency, allowing investors to make value-based decisions through side-by-side comparisons of cost structures.

Investment Objective & Policy

This section outlines what the fund aims to achieve and how it plans to get there. It covers the fund's strategy, target assets, and any specific objectives it may have, such as capital preservation, growth, or income generation.

Understanding these elements allows investors to align their choices with their own financial goals. FundScouter enables investors by providing clear insight into each fund's objectives and approach through our comprehensive fund database.

Recommended Holding Period

The recommended holding period serves as a guideline for how long an investor should ideally maintain the investment to achieve optimal returns. This timeframe varies based on the fund type and its underlying assets.

Funds with higher volatility or those invested in long-term projects typically recommend longer holding periods. Considering this timeframe helps investors better plan their investment horizon and align it with their financial objectives.

How FundScouter Displays KID Information

At FundScouter, we believe in making this critical regulatory information accessible and easy to understand. On our individual fund pages, we prominently display key KID metrics to help you make informed decisions.

For example, on the Altaroc Odyssey 2024 fund page, you'll find:

Annual returns (KID)

Stressed

4.2%

Moderate

12.5%

Favorable

20.4%

Average total cost level (KID)

3.34%

KID Risk Indicator: 6 out of 7

This visual representation makes it easy to understand the risk-return profile of each fund at a glance. The risk indicator clearly shows where a fund falls on the risk spectrum, while the performance scenarios provide transparency about potential outcomes under different market conditions.

You can explore these KID metrics across our entire fund database, including options like Flowstone Opportunity Fund, Moonfare Core III, and many others. Each fund page presents these metrics in a consistent format, enabling apples-to-apples comparisons.

Conclusion

FundScouter is committed to making private market investing more transparent and accessible. Understanding the components outlined in a Key Information Document (KID) is a significant first step toward achieving this goal.

Whether you're an individual investor, financial advisor, institutional investor, or family office, knowledge of KID factors will enhance your investment decision-making process. Our objective, data-driven fund comparison tools empower you to navigate the complex world of private market investments with confidence and clarity.

Explore More