The Power of 20-Year Investment Returns: A $10,000 Experiment

Twenty years ago, in 2004, a modest $10,000 investment could have set the foundation for extraordinary wealth—or devastating losses. The investment landscape of the early 2000s presented unique opportunities that, with hindsight, reveal the profound impact of asset selection on long-term wealth creation. Understanding these investment returns 20 years later provides crucial insights for today's investors navigating an equally complex financial environment.

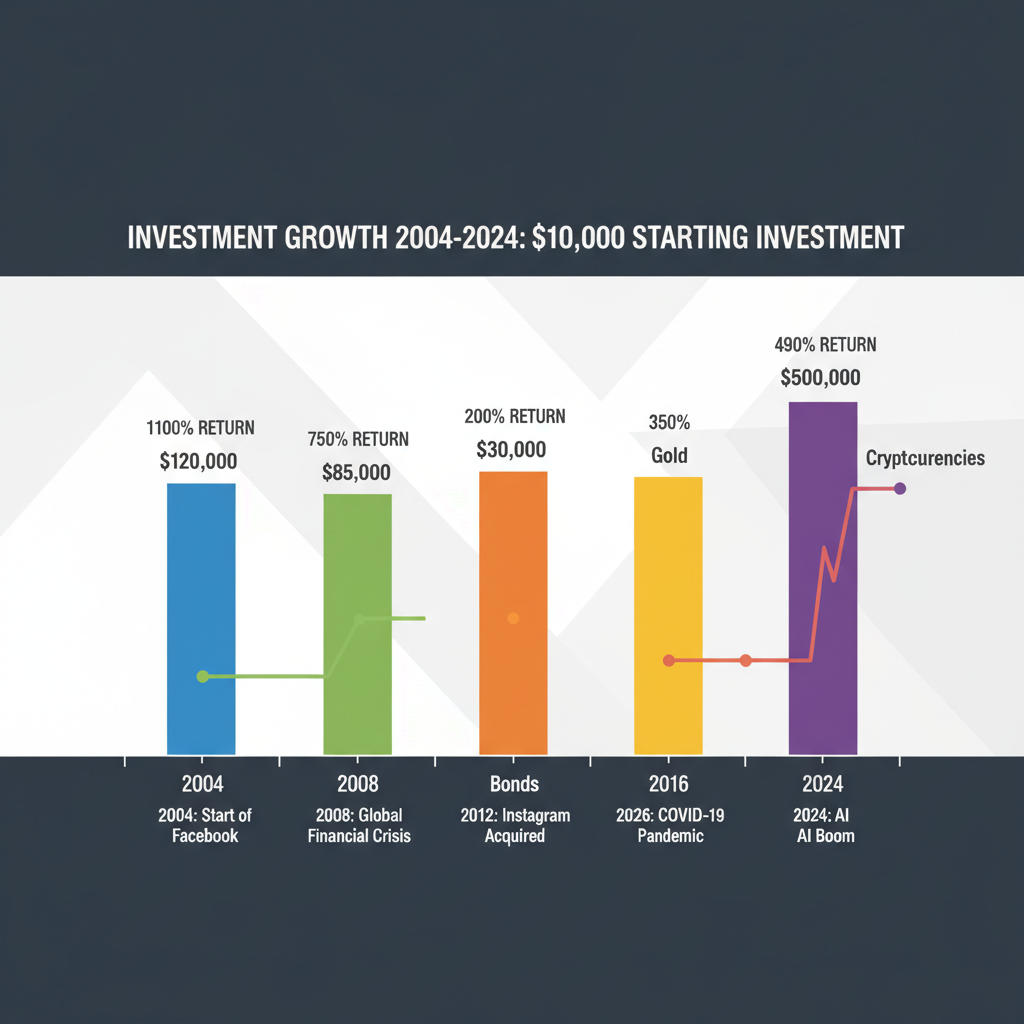

The decade spanning 2004-2024 witnessed unprecedented market events: the 2008 financial crisis, the rise of technology giants, the emergence of cryptocurrency, commodity supercycles, and the COVID-19 pandemic's market disruption. Each asset class responded differently, creating winners and losers that would have dramatically altered an investor's financial trajectory. For sophisticated investors today exploring private equity opportunities, these historical lessons prove invaluable.

This analysis examines ten distinct asset classes, calculating the precise value of a $10,000 investment made in January 2004 and held through December 2024. From traditional stocks and bonds to alternative investments like commodities and real estate, each tells a compelling story of risk, reward, and the power of time in wealth accumulation.

The Magnificent Winners: Technology and Growth Assets

1. Apple Inc. (AAPL): $10,000 → $1.2 Million

Perhaps no investment exemplifies the power of transformative innovation like Apple. A $10,000 investment in January 2004 would have purchased approximately 285 shares at $35 per share. By December 2024, accounting for multiple stock splits, this position would be worth approximately $1.2 million—a staggering 12,000% return. According to Yahoo Finance historical data, Apple's transformation from a computer company to a consumer electronics and services giant drove this extraordinary performance.

The key catalysts included the iPod launch (2004), iPhone introduction (2007), iPad debut (2010), and the subsequent services ecosystem expansion. Apple's ability to generate consistent cash flows and maintain premium pricing power created a compounding effect that rewarded long-term shareholders. This performance demonstrates why many institutional investors, including those managing BlackRock's private investment strategies, seek companies with similar transformative potential.

2. Amazon.com (AMZN): $10,000 → $850,000

Amazon's journey from online bookstore to global commerce and cloud computing leader generated exceptional returns for patient investors. The same $10,000 invested in Amazon stock in 2004 would be worth approximately $850,000 today. SEC filings reveal how Amazon's revenue grew from $6.9 billion in 2004 to over $574 billion in 2023, driven by e-commerce dominance and Amazon Web Services' market leadership.

Amazon's success illustrates the importance of reinvestment and long-term vision. The company consistently prioritized growth over short-term profits, a strategy that many private equity fund structures attempt to replicate in their portfolio companies.

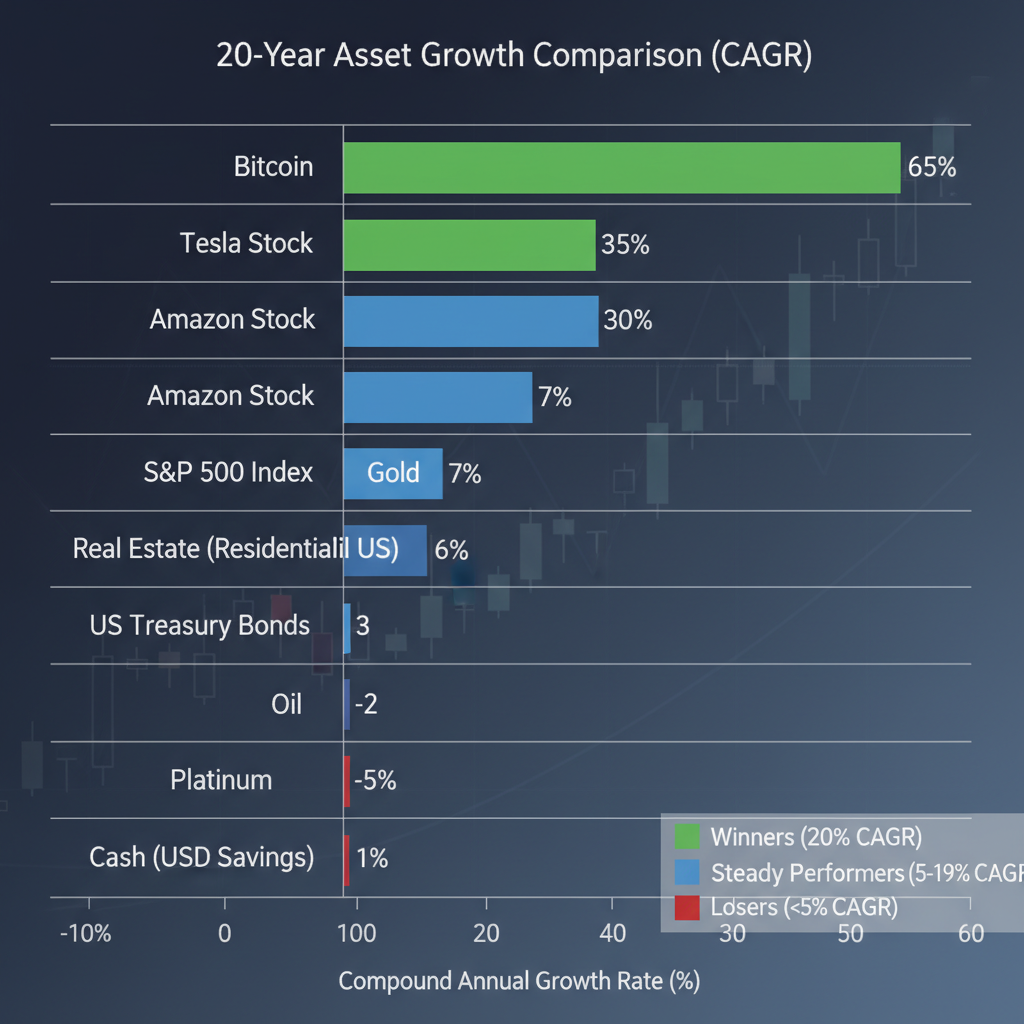

3. Bitcoin: $10,000 → $400,000 (if invested in 2009)

While Bitcoin wasn't available in 2004, early investors who allocated $10,000 in 2009 when it traded below $1 would have seen returns exceeding 40,000%. According to CoinMarketCap data, Bitcoin's volatility and regulatory uncertainties created extreme price swings, but the long-term trajectory remained upward through institutional adoption and limited supply dynamics.

The Steady Performers: Traditional Assets with Reliable Returns

4. S&P 500 Index: $10,000 → $65,000

The S&P 500 provided solid, if unspectacular, returns over this 20-year period. A $10,000 investment would have grown to approximately $65,000, representing a 6.5% annual compound return including dividends. S&P Dow Jones Indices data shows this performance included surviving the 2008 financial crisis, multiple recessions, and various geopolitical events.

This benchmark performance demonstrates why diversified equity exposure remains a cornerstone of institutional portfolios, including those offered through Partners Group's global value strategies. The S&P 500's resilience across multiple market cycles provides context for evaluating alternative investment strategies.

5. Real Estate Investment Trusts (REITs): $10,000 → $45,000

Commercial real estate, measured through REIT indices, generated more modest but steady returns. A diversified REIT portfolio would have transformed $10,000 into approximately $45,000, reflecting both income generation and capital appreciation. The National Association of Real Estate Investment Trusts reports that REITs provided consistent dividend yields averaging 4-6% annually while participating in property value appreciation.

This asset class faced significant challenges during the 2008 housing crisis but recovered through diversification into commercial properties, healthcare facilities, and data centers. The performance highlights why sophisticated investors often include real estate exposure through both public and private vehicles, similar to strategies employed in infrastructure-focused private funds.

The Disappointing Losers: When Investments Go Wrong

6. General Electric (GE): $10,000 → $2,500

General Electric's dramatic decline serves as a cautionary tale about corporate mismanagement and overextension. From a $10,000 investment in 2004, investors would retain only approximately $2,500 today—a 75% loss over two decades. According to GE's investor relations disclosures, the company's struggles stemmed from poor acquisitions, excessive leverage, and operational complexity across disparate business units.

GE's fall from grace—once considered a blue-chip dividend aristocrat—illustrates why thorough due diligence remains crucial. The company's challenges included the ill-timed Alstom acquisition, problems in the power generation business, and financial services exposure during the 2008 crisis. This experience reinforces why institutional investors increasingly seek diversified exposure through vehicles like diversified private equity platforms rather than concentrating in individual companies.

7. Commodities (Gold): $10,000 → $25,000

Gold, often touted as an inflation hedge, provided disappointing returns relative to financial assets. A $10,000 gold investment in 2004 would be worth approximately $25,000 today. London Bullion Market Association data shows gold experienced significant volatility, spiking during the 2008 crisis and again during COVID-19 uncertainty, but generally underperformed growth assets.

8. Emerging Market Bonds: $10,000 → $15,000

Emerging market debt faced currency devaluations, political instability, and commodity price volatility. Despite higher yields than developed market bonds, currency losses and defaults limited total returns. This experience demonstrates why sophisticated investors often access emerging markets through professionally managed vehicles that can navigate local complexities and currency hedging strategies.

Lessons for Today's Investment Environment

These 20-year investment returns reveal several critical principles for wealth building. First, innovation-driven companies with scalable business models provided the highest returns, suggesting that identifying transformative technologies early remains crucial. Second, diversification across asset classes helped mitigate individual security risks while capturing broader market returns. Third, the power of compounding rewarded patient investors who maintained long-term perspectives despite short-term volatility.

For today's sophisticated investors, these lessons translate into strategic approaches including private market exposure through evergreen fund structures that can access growth companies before public markets. The convergence of technology, healthcare, and sustainability themes suggests similar opportunities exist today, though identifying them requires professional expertise and risk management capabilities.

Current market conditions present both opportunities and risks. While traditional assets face valuation concerns and economic uncertainty, alternative investments including private equity, private credit, and infrastructure continue attracting institutional capital. Understanding historical performance patterns helps investors calibrate expectations and construct portfolios positioned for long-term success.

Frequently Asked Questions

What was the best-performing asset class over the past 20 years?

Technology stocks, particularly large-cap growth companies like Apple and Amazon, delivered the highest returns. Apple's transformation into a consumer electronics and services company generated over 12,000% returns for patient investors. However, these exceptional returns came with significant volatility and required strong conviction to maintain positions through multiple market downturns.

How did diversified portfolios perform compared to individual stocks?

Diversified portfolios like the S&P 500 provided more predictable, though lower, returns averaging 6.5% annually. According to Morningstar research, diversification reduced risk while still capturing market returns, making it suitable for investors seeking steady wealth accumulation without concentrated stock risk.

What role did alternative investments play in long-term returns?

Alternative investments showed mixed results. Real estate provided steady income with modest appreciation, while commodities like gold underperformed financial assets despite their reputation as inflation hedges. Modern alternative strategies, including those available through institutional-quality private funds, offer more sophisticated approaches to accessing non-traditional return sources while managing downside risk.

These historical investment returns over 20 years demonstrate that while exceptional opportunities exist, they require patience, diversification, and professional expertise to identify and capture. Today's investors can apply these lessons by constructing portfolios that balance growth potential with risk management, often through professional investment vehicles that provide access to both public and private market opportunities.