Why These Investment Strategies Remain Hidden from Retail Investors

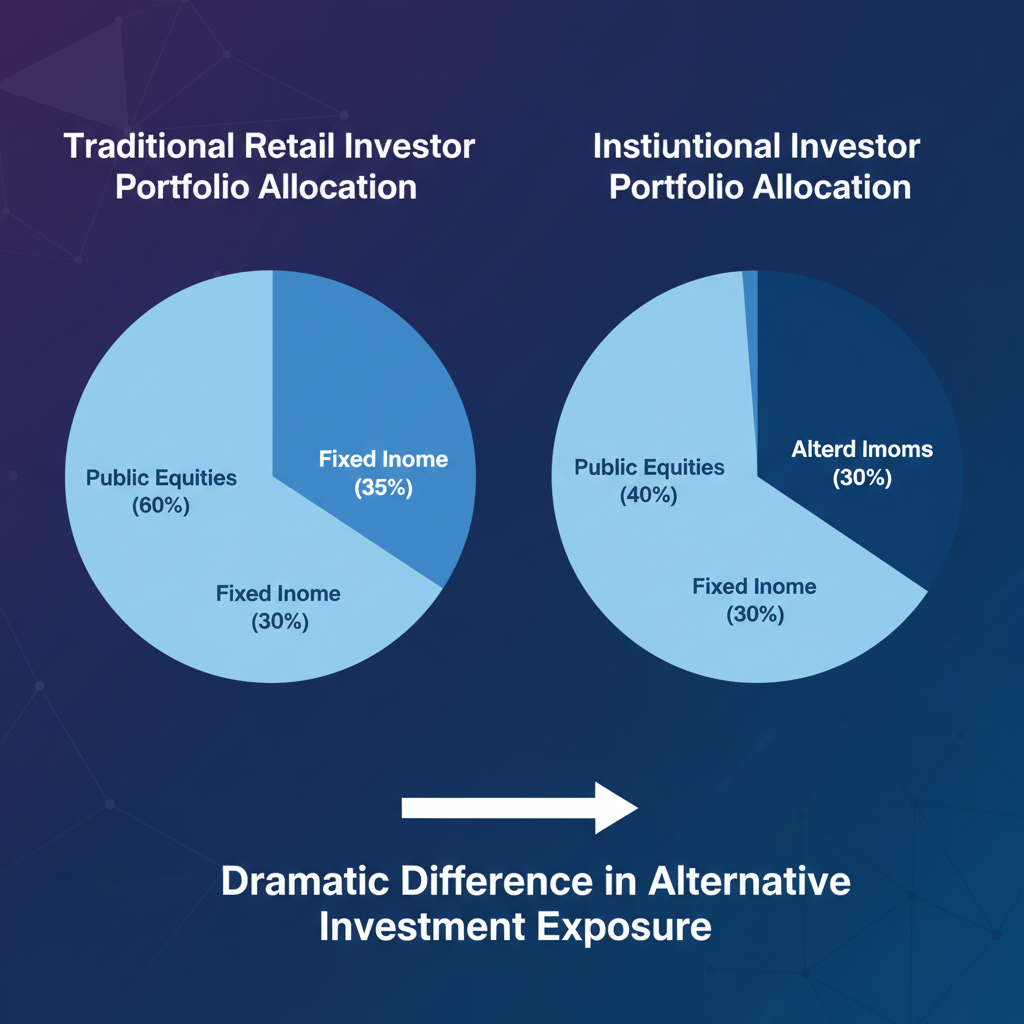

The investment landscape is fundamentally unfair. While institutional investors leverage sophisticated investment strategies to generate alpha, retail investors are often limited to basic stocks, bonds, and mutual funds. According to Preqin's 2024 Alternative Assets Report, institutional investors allocate over 30% of their portfolios to alternative investments, compared to less than 5% for individual investors.

The disparity isn't accidental. Large financial institutions profit significantly from keeping sophisticated strategies exclusive to high-net-worth clients and institutional accounts. These firms often require minimum investments of $1-25 million, effectively gatekeeping proven methodologies that could benefit smaller investors. However, regulatory changes and technological innovations are beginning to democratize access to these previously exclusive investment approaches.

Understanding these hidden strategies can fundamentally transform your investment approach. From secondary market opportunities to co-investment structures, the techniques outlined here represent decades of institutional wisdom traditionally reserved for endowments, pension funds, and ultra-high-net-worth families.

Strategy #1: Private Equity Secondary Market Investments

The private equity secondary market represents one of the most lucrative yet overlooked investment opportunities available today. Secondary transactions involve purchasing existing limited partner interests in private equity funds, often at significant discounts to net asset value (NAV). SEC data from Q4 2023 shows secondary transaction volumes reached $104 billion, yet most retail investors remain unaware of these opportunities.

The strategy works because institutional investors occasionally need liquidity before a fund's natural maturation. This creates opportunities for savvy investors to acquire positions at 10-30% discounts to NAV. For example, specialized secondary funds have emerged to capitalize on these market inefficiencies, offering retail investors access to pre-vetted opportunities.

The key advantages include reduced J-curve effects, diversified vintage years, and accelerated cash flows. Unlike primary fund investments that require years to deploy capital, secondary positions often begin generating distributions immediately. Cambridge Associates research demonstrates that secondary funds have historically outperformed primary funds on a risk-adjusted basis.

However, investors must carefully evaluate underlying portfolio companies, remaining fund life, and discount rates. Due diligence becomes even more critical since you're inheriting previous investment decisions. The strategy requires patience and sophisticated analysis, explaining why institutions prefer to keep it within their inner circles.

Strategy #2: Co-Investment Alongside Established Fund Managers

Co-investment opportunities allow investors to participate directly in specific deals alongside established fund managers, typically without paying management fees or carried interest on the co-invested portion. This strategy has exploded in popularity among institutional investors, with McKinsey's 2024 Private Markets Review reporting that 78% of limited partners actively pursue co-investment opportunities.

The appeal is obvious: reduced fees can increase net returns by 200-400 basis points annually. When a fund manager identifies an attractive opportunity requiring more capital than their fund can provide, they offer co-investment slots to their limited partners. This creates a win-win scenario where managers can pursue larger deals while investors access premium opportunities at reduced cost structures.

Platforms like specialized co-investment vehicles are beginning to democratize access to these opportunities. Previously, co-investments were exclusively available to investors with $50+ million fund commitments. Today, innovative structures allow smaller investors to participate through pooled vehicles.

The strategy requires careful manager selection and deal-specific analysis. Not all co-investment opportunities are created equal – managers sometimes offer their worst deals to co-investors while keeping the best opportunities within their main funds. Successful co-investment requires understanding the manager's track record, alignment of interests, and specific deal dynamics.

Strategy #3: Evergreen Fund Structures for Continuous Compounding

Traditional private equity funds follow a finite lifecycle model, returning capital to investors after 7-10 years regardless of market conditions. Evergreen fund structures revolutionize this approach by allowing continuous reinvestment of proceeds, creating a compounding effect that traditional structures cannot achieve.

The strategy addresses a fundamental flaw in conventional private equity: forced liquidations during suboptimal market conditions. Bain's 2024 Global Private Equity Report highlights how evergreen structures have delivered superior long-term returns by eliminating the pressure to sell assets during market downturns.

Leading institutions like Ardian have pioneered evergreen vehicles that combine the best aspects of private equity returns with mutual fund-like liquidity. These structures typically offer quarterly redemption opportunities while maintaining the illiquidity premium that drives private market outperformance.

The key advantage lies in timing flexibility. Rather than being forced to sell portfolio companies at predetermined dates, evergreen funds can hold assets through multiple cycles, crystallizing value at optimal moments. This patient capital approach has historically generated 150-300 basis points of additional annual returns compared to traditional structures.

Strategy #4: Semi-Liquid Private Credit for Enhanced Yield

Private credit has emerged as a $1.7 trillion asset class, yet most retail investors remain confined to traditional bonds yielding 3-5%. Semi-liquid private credit strategies bridge the gap between illiquid private debt and liquid public markets, offering enhanced yields with manageable liquidity constraints.

The opportunity exists because middle-market companies often cannot access traditional bank financing or public debt markets efficiently. This creates a lending gap that private credit funds exploit, typically earning 8-12% annual returns. Preqin's H1 2024 Private Debt Report shows default rates remain below 2%, significantly lower than high-yield bonds.

Sophisticated investors access these opportunities through vehicles like semi-liquid private credit funds that offer quarterly liquidity while maintaining exposure to illiquid underlying assets. This structure allows managers to pursue longer-duration loans while providing investors reasonable access to their capital.

The strategy particularly excels during economic uncertainty when traditional credit markets become volatile. Private credit's floating-rate nature provides natural inflation protection, while senior secured positions offer downside protection. However, investors must understand credit selection processes, manager expertise, and underlying portfolio diversification.

Strategy #5: Infrastructure and Real Assets for Inflation Protection

While most investors chase growth stocks and technology funds, institutional investors quietly allocate 10-15% of portfolios to infrastructure and real assets. These investments provide inflation protection, stable cash flows, and portfolio diversification benefits that traditional asset classes cannot replicate. Cambridge Associates data shows infrastructure investments have delivered 9.2% annual returns over the past decade while exhibiting significantly lower volatility than public equities.

The strategy capitalizes on essential services that generate predictable, inflation-linked revenue streams. Toll roads, utilities, airports, and telecommunications infrastructure possess natural monopoly characteristics and regulatory protection that create sustainable competitive advantages. These assets often feature built-in inflation escalators, making them particularly attractive during periods of monetary expansion.

Access has traditionally required $25+ million minimum investments, but innovative structures like diversified infrastructure funds are democratizing the opportunity. These vehicles combine multiple infrastructure assets across sectors and geographies, reducing single-asset risk while maintaining the asset class's attractive characteristics.

Climate transition creates additional opportunities within infrastructure investing. Renewable energy projects, electric vehicle charging networks, and energy storage facilities represent multi-decade investment themes supported by government policy and private sector adoption. The strategy requires understanding regulatory frameworks, technology risks, and long-term demand drivers, explaining why institutions prefer to limit competition from retail investors.

Implementation: Accessing These Institutional-Grade Strategies

Successfully implementing these investment strategies requires careful consideration of minimum investments, due diligence processes, and portfolio allocation. Most institutional strategies require longer investment horizons and higher risk tolerance than traditional investments. Start by allocating 10-20% of your portfolio to alternative strategies, gradually increasing exposure as you gain experience and comfort.

Due diligence becomes paramount when accessing these sophisticated strategies. Evaluate manager track records, fee structures, investment processes, and portfolio construction methodologies. Understanding different fund structures helps identify which vehicles align with your liquidity needs and tax situation.

Tax implications deserve special attention since many alternative investment strategies generate different tax treatment than traditional investments. Consult qualified tax professionals to optimize structure selection and timing of investments and distributions.

Frequently Asked Questions

What minimum investment is typically required for these strategies?

Minimum investments vary significantly by strategy and vehicle. Traditional institutional access required $1-25 million minimums, but innovative fund structures now offer access starting at $25,000-250,000. Modern alternative investment platforms continue reducing barriers to entry through pooled vehicles and technology-enabled distribution.

How do these strategies perform during market downturns?

Alternative investment strategies typically exhibit lower correlation with public markets, providing valuable diversification during downturns. However, illiquidity can become a constraint during crisis periods when investors need immediate access to capital. Federal Reserve research shows private markets maintain more stable valuations during volatile periods, though this can mask underlying risk.

Are these strategies suitable for retirement accounts?

Many alternative investment strategies work well within retirement account structures, particularly self-directed IRAs. The tax-deferred nature of retirement accounts helps optimize returns from strategies that generate ordinary income rather than capital gains. However, UBTI (Unrelated Business Taxable Income) considerations may apply to certain fund structures, requiring careful tax planning.

These five investment strategies represent just the beginning of what's possible when you think beyond traditional asset allocation. The key lies in education, patience, and gradual implementation. As regulatory changes continue expanding access to institutional-grade strategies, sophisticated individual investors can increasingly compete on more equal footing with large institutions.