Why Private Equity Secondaries Valuation Matters More Than Ever in 2025

The private equity secondaries market has experienced explosive growth, with transaction volumes reaching $114 billion in 2023 according to Preqin's latest data. As institutional investors increasingly turn to secondaries for portfolio optimization and liquidity management, mastering private equity secondaries valuation has become a critical skill for fund managers, family offices, and sophisticated investors alike.

The complexity of valuing secondaries transactions stems from their unique nature – investors are purchasing existing commitments to private equity funds rather than making direct investments. This creates multiple layers of valuation considerations, from underlying portfolio company performance to fund-specific dynamics and market timing factors. With new regulatory frameworks and evolving market conditions in 2025, traditional valuation approaches are being challenged and refined.

Understanding private equity secondaries valuation is essential for several reasons: it enables more accurate pricing in transactions, helps investors identify compelling opportunities, and supports better risk management across institutional portfolios. For fund managers like those at Moonfare's Secondary Fund, sophisticated valuation methodologies directly impact investment decisions and portfolio performance.

This comprehensive guide examines the latest valuation best practices, from traditional net asset value (NAV) analysis to emerging methodologies that account for today's market dynamics. We'll explore discount rate considerations, portfolio-level adjustments, and the impact of GP-led transactions on valuation frameworks. Whether you're evaluating direct secondaries or complex restructuring transactions, these insights will enhance your valuation accuracy and investment outcomes.

Understanding the Secondaries Market Landscape in 2025

The private equity secondaries market has evolved dramatically over the past decade, transitioning from a niche liquidity solution to a mainstream asset class with sophisticated investment strategies. McKinsey research indicates that secondary transaction volumes have grown at a compound annual growth rate of 15% since 2015, driven by increased LP portfolio management needs and the maturation of GP-led processes.

Traditional direct secondaries, where limited partners sell their fund commitments to secondary buyers, continue to represent the majority of transaction volume. However, GP-led secondaries have emerged as a significant market segment, accounting for approximately 40% of total deal flow in 2024. These transactions, including continuation funds and strip sales, require distinct valuation approaches due to their structural complexity and alignment considerations.

Market participants have also diversified significantly. Dedicated secondary funds have raised record amounts of capital, with many private equity strategies now incorporating secondary elements into their investment approach. This increased competition has compressed traditional discount rates, particularly for high-quality vintage portfolios, forcing investors to develop more nuanced valuation frameworks.

Regulatory changes in 2025 have further shaped the market landscape. Enhanced transparency requirements and standardized reporting frameworks have improved data quality, while new liquidity regulations for institutional investors have created additional demand for secondary solutions. These developments have made accurate valuation more critical but also more achievable through improved information flow and market standardization.

Key Market Drivers Affecting Valuations

Several macro and micro factors significantly influence secondaries valuations in the current environment. Interest rate volatility has created uncertainty around discount rate assumptions, while extended hold periods for underlying investments have increased the complexity of cash flow projections. Additionally, the growing prevalence of continuation funds has introduced new valuation considerations around GP incentives and portfolio optimization strategies.

Core Valuation Methodologies for Private Equity Secondaries

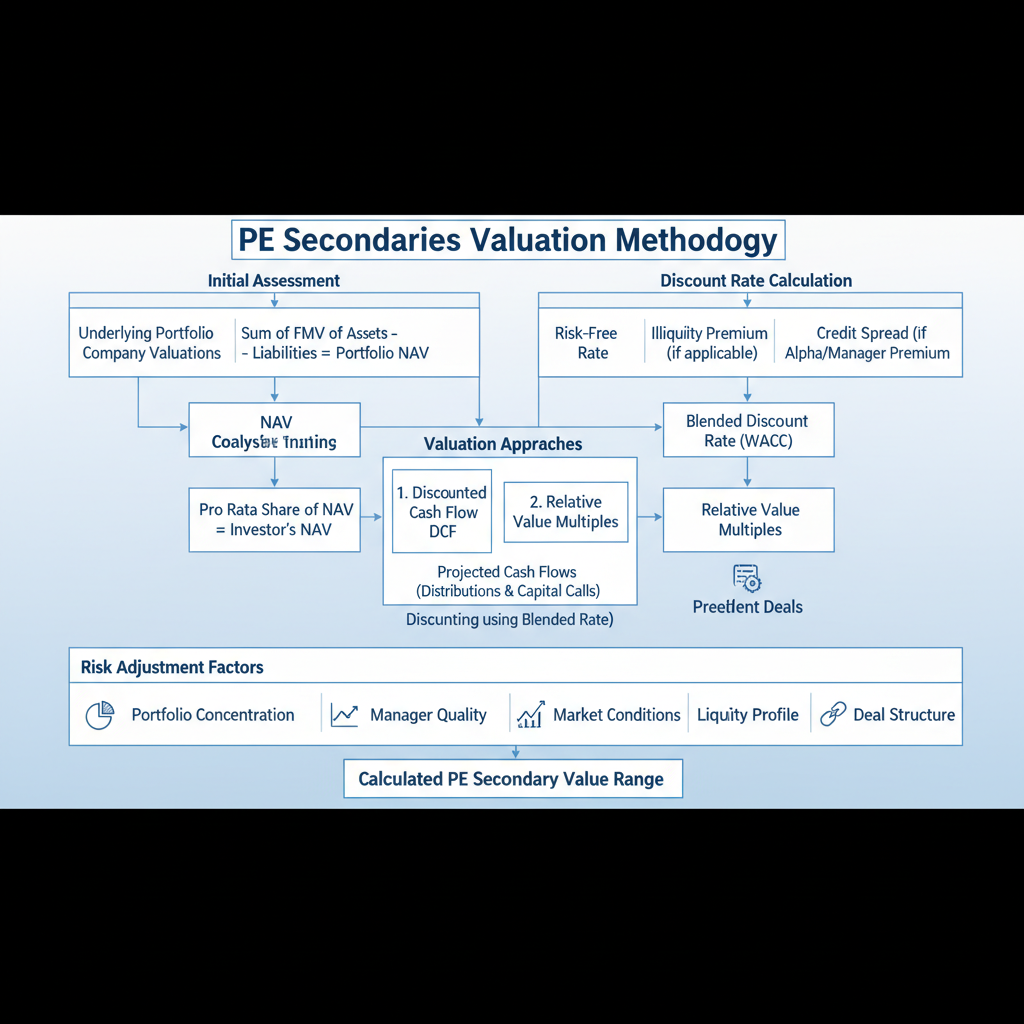

Effective private equity secondaries valuation requires a multi-faceted approach that combines quantitative analysis with qualitative assessment of fund-specific and portfolio-level factors. The foundation of most valuation exercises begins with Net Asset Value (NAV) analysis, but sophisticated investors employ several complementary methodologies to achieve more accurate pricing and risk assessment.

The Discounted Cash Flow (DCF) approach remains the most widely used methodology for secondaries valuation. This method involves projecting future distributions from the underlying portfolio companies, applying appropriate discount rates, and calculating the present value of expected cash flows. However, the challenge lies in accurately forecasting both the timing and magnitude of distributions, particularly for funds with complex portfolio compositions or those operating in volatile market conditions.

Multiple-based valuation provides an important cross-check to DCF analysis by comparing the transaction to similar market precedents. This approach examines recent secondary transactions involving comparable funds, adjusting for differences in vintage year, portfolio quality, and market timing. PitchBook's 2024 secondary market data shows that transaction multiples have varied significantly across different fund categories, with growth equity funds commanding premium valuations relative to traditional buyout strategies.

Asset-level analysis represents the most granular valuation approach, particularly relevant for GP-led transactions where investors can evaluate individual portfolio companies. This methodology involves building detailed financial models for each underlying investment, incorporating company-specific growth assumptions, market dynamics, and exit timing considerations. While resource-intensive, asset-level analysis provides the highest degree of valuation precision and risk assessment capability.

For funds pursuing evergreen fund structures, valuation methodologies must account for the continuous investment and liquidity features that distinguish these vehicles from traditional closed-end funds. The ongoing nature of evergreen funds requires dynamic valuation models that can accommodate regular capital deployment and redemption activity.

Hybrid Approach: Combining Multiple Methodologies

Best practice in 2025 involves combining multiple valuation approaches to achieve a more robust and defensible pricing framework. Leading secondary investors typically employ a weighted average of DCF analysis, market multiples, and asset-level assessments, with the weighting determined by data quality, transaction complexity, and market conditions. This hybrid approach helps mitigate the inherent limitations of any single methodology while providing multiple perspectives on value.

NAV Analysis and Discount Rate Determination

Net Asset Value analysis serves as the cornerstone of private equity secondaries valuation, providing the baseline from which discount and premium adjustments are applied. However, NAV figures reported by general partners represent just one data point in a comprehensive valuation framework. Sophisticated secondary investors conduct detailed NAV quality assessments, examining the underlying assumptions, valuation methodologies, and timing of the reported figures.

The quality and recency of NAV data significantly impacts valuation accuracy. NAV figures are typically reported quarterly with a lag, meaning that the most recent available data may be three to six months old at the time of transaction. This lag creates particular challenges in volatile market environments, where underlying portfolio company valuations may have shifted materially since the last reporting period. Leading secondary investors maintain proprietary databases of public market comparables to adjust NAV figures for market movements and sector-specific trends.

Discount rate determination represents perhaps the most critical element of the valuation process. Traditional approaches focus on fund-specific factors such as vintage year, portfolio quality, and remaining fund life. However, the market evolution has required more sophisticated discount rate frameworks that incorporate broader market conditions, investor-specific requirements, and transaction structure considerations.

Current market data suggests that discount rates vary significantly across fund categories and transaction types. According to Cambridge Associates' 2025 market outlook, traditional buyout funds from top-tier GPs are trading at discounts of 5-15% to NAV, while growth equity and venture capital funds may command premiums of 5-20% depending on portfolio composition and market conditions. These variations reflect different risk profiles, liquidity expectations, and growth prospects across investment strategies.

The discount rate applied must also reflect the specific characteristics of the secondary transaction structure. Direct secondaries typically require different discount rates than GP-led continuation funds, which may involve additional fees, extended hold periods, or modified economic terms. Secondary buyers must carefully analyze these structural elements to ensure their discount rate assumptions appropriately capture the total economic impact of the investment.

For investors considering opportunities with established secondary specialists like Coller's secondary equity funds, understanding these NAV analysis and discount rate methodologies becomes essential for evaluating fund performance and investment rationale.

Adjusting for Portfolio Company Performance

NAV analysis must also incorporate forward-looking adjustments based on individual portfolio company performance and market positioning. This requires detailed analysis of each underlying investment, including financial performance trends, market share dynamics, and competitive positioning. Sophisticated secondary investors maintain research capabilities to independently assess portfolio company prospects and identify potential value drivers or risks not fully captured in reported NAV figures.

Emerging Valuation Frameworks and Technology Integration

The private equity secondaries market has witnessed significant innovation in valuation methodologies, driven by improved data availability, technological advancement, and the growing sophistication of market participants. Machine learning algorithms and artificial intelligence are increasingly being deployed to enhance traditional valuation approaches, particularly in areas such as cash flow forecasting, risk assessment, and market timing optimization.

Alternative data sources have become integral to modern secondaries valuation frameworks. Satellite imagery, social media sentiment analysis, and real-time economic indicators provide additional insights into portfolio company performance and market conditions. These data sources are particularly valuable for evaluating technology and consumer-focused investments, where traditional financial metrics may lag actual business performance.

Environmental, Social, and Governance (ESG) considerations have evolved from supplementary analysis to core valuation components. BlackRock's latest research demonstrates that ESG factors can significantly impact long-term investment returns and risk profiles. Secondary investors now incorporate ESG scoring into their discount rate calculations, with companies demonstrating strong ESG practices commanding premium valuations, particularly in European markets where regulatory requirements are more stringent.

Blockchain technology and distributed ledger systems are beginning to impact secondaries valuation through improved transaction transparency and data integrity. While still in early stages, these technologies promise to enhance the accuracy and timeliness of portfolio company reporting, potentially reducing the valuation uncertainty that has historically characterized secondary transactions.

Scenario modeling has become more sophisticated, with many secondary investors employing Monte Carlo simulations to assess valuation ranges under different market conditions. These models incorporate multiple variables including interest rates, market volatility, sector performance, and macroeconomic indicators to generate probability-weighted valuation outcomes. This approach provides investors with better risk assessment capabilities and more informed decision-making frameworks.

The integration of these emerging technologies and methodologies requires significant investment in systems and personnel, creating competitive advantages for well-resourced market participants. Funds like Hamilton Lane's Private Markets Access ELTIF leverage proprietary technology platforms to enhance their valuation capabilities and investment decision-making processes.

Real-Time Valuation Monitoring

Technology advancement has enabled more frequent valuation updates and real-time monitoring of portfolio performance. Digital platforms now provide secondary investors with continuous access to portfolio company data, market comparables, and performance metrics. This real-time visibility allows for more dynamic valuation adjustments and improved timing of transaction execution.

GP-Led Transactions and Complex Structures Valuation

GP-led secondary transactions have introduced new complexities to private equity secondaries valuation, requiring specialized frameworks that account for the unique characteristics of continuation funds, strip sales, and other sponsor-led restructuring activities. These transactions often involve extended hold periods, modified fee structures, and alignment considerations that traditional valuation methodologies may not adequately capture.

Continuation funds represent the most common type of GP-led transaction, where general partners transfer selected portfolio companies into new fund vehicles to extend hold periods and pursue additional value creation opportunities. Valuing these transactions requires careful analysis of the general partner's value creation thesis, the quality and potential of the underlying assets, and the terms of the new fund structure. The challenge lies in balancing the potential for additional returns against the extended risk exposure and modified economic terms.

The valuation process for GP-led transactions must incorporate several unique factors. First, the selection bias inherent in these transactions – general partners typically choose their highest-conviction investments for continuation structures – may justify premium valuations but also increases concentration risk. Second, the extended hold periods modify traditional cash flow timing assumptions, requiring longer-duration DCF models with higher terminal value components.

Strip sales and other partial liquidity transactions create additional valuation complexity due to their hybrid nature, providing partial liquidity while maintaining ongoing exposure to the underlying assets. These structures require careful modeling of both the immediate liquidity component and the continuing investment value, often resulting in blended valuation approaches that combine immediate proceeds with ongoing asset values.

Alignment analysis has become critical in GP-led transaction valuation. Investors must assess whether the economic terms of the new structure provide appropriate incentives for the general partner while protecting limited partner interests. This includes evaluation of management fee structures, carried interest arrangements, and governance provisions that may impact future value creation activities.

Fee structure modifications in GP-led transactions can significantly impact net returns to investors and must be carefully incorporated into valuation models. Many continuation funds feature reduced management fees or modified carried interest structures that may improve investor returns but also change the economic dynamics of the investment. These modifications require detailed analysis to understand their impact on total returns and risk-adjusted performance.

The growing sophistication of GP-led transactions has created opportunities for specialized secondary investors who can effectively navigate these complex structures. Understanding the nuances of GP-led valuation is essential for investors considering opportunities with experienced secondary managers or semi-liquid fund structures that may incorporate similar features.

Due Diligence Considerations for GP-Led Deals

GP-led transaction valuation requires enhanced due diligence procedures that extend beyond traditional financial analysis. This includes assessment of the general partner's track record with similar transactions, analysis of the specific value creation opportunities identified for the continuation period, and evaluation of the market dynamics affecting the underlying portfolio companies. The due diligence process must also examine potential conflicts of interest and ensure that the transaction terms reflect arm's-length pricing.

Risk Assessment and Portfolio-Level Adjustments

Comprehensive private equity secondaries valuation extends beyond individual fund analysis to incorporate portfolio-level risk assessment and diversification considerations. Secondary investors must evaluate how new investments interact with existing holdings, considering correlation effects, concentration limits, and overall portfolio optimization objectives. This portfolio-level analysis can significantly impact valuation decisions and investment allocation strategies.

Correlation analysis represents a critical component of portfolio-level valuation adjustments. Secondary portfolios often exhibit higher correlation than originally anticipated due to shared market exposures, sector concentrations, or vintage year clustering. SEC guidance from 2023 emphasizes the importance of correlation analysis in alternative investment portfolio construction, particularly for institutional investors subject to concentration limits or diversification requirements.

Liquidity profiling has become essential for secondary investors, particularly those managing portfolios with specific liquidity objectives or redemption features. Different secondary investments provide varying liquidity profiles based on fund characteristics, portfolio maturity, and distribution patterns. These liquidity considerations may justify valuation adjustments, with more liquid investments commanding premium valuations in certain market conditions.

Currency and geographic exposure analysis adds another layer of complexity to portfolio-level valuation. Secondary portfolios often include investments across multiple currencies and geographic regions, creating foreign exchange risk and regulatory exposure that may not be apparent at the individual fund level. Sophisticated investors employ currency hedging strategies and geographic diversification frameworks that influence their valuation and investment allocation decisions.

Vintage year diversification remains a fundamental principle of secondary portfolio construction, but requires careful analysis of how different vintages interact under various market scenarios. The prolonged bull market of the 2010s created vintage year concentrations in many secondary portfolios, potentially increasing downside risk during market corrections. Valuation models must account for these concentration effects and their impact on portfolio-level returns and risk profiles.

Manager concentration analysis has gained importance as secondary investors recognize the outsized impact of general partner selection on investment outcomes. Portfolios with significant exposure to specific general partners or management teams may exhibit higher correlation and concentration risk than initially apparent. This analysis influences both valuation decisions and ongoing portfolio management activities.

For institutional investors utilizing various fund structures to access secondary opportunities, understanding these portfolio-level considerations becomes essential for effective risk management and performance optimization.

Stress Testing and Scenario Analysis

Modern secondary valuation frameworks incorporate comprehensive stress testing and scenario analysis to assess portfolio resilience under adverse market conditions. This includes modeling of recession scenarios, interest rate shocks, and sector-specific downturns that may disproportionately impact certain secondary investments. The results of these stress tests often inform valuation adjustments and portfolio allocation decisions, helping investors maintain appropriate risk levels across different market environments.

Regulatory and Compliance Considerations in Valuation

The regulatory landscape for private equity secondaries has evolved significantly in 2025, with new reporting requirements, valuation standards, and investor protection measures impacting how secondary transactions are valued and executed. These regulatory changes have created both challenges and opportunities for secondary investors, requiring enhanced compliance frameworks while potentially improving market transparency and efficiency.

Fair value accounting standards have been refined to address the unique characteristics of secondary investments, particularly regarding the treatment of purchase price discounts and ongoing valuation adjustments. The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) now provide more specific guidance for secondary investment accounting, helping to standardize valuation practices across different jurisdictions and investor types.

European AIFMD regulations have introduced enhanced transparency requirements for alternative investment funds, including more detailed reporting of secondary investment activities and valuation methodologies. These requirements have improved data quality and market transparency, but also increased compliance costs and operational complexity for secondary investors operating in European markets.

The SEC's private fund rules, implemented in 2024, have created new disclosure and reporting requirements for US-based secondary investors. These rules require more detailed fee and expense reporting, enhanced transparency around conflicts of interest, and standardized performance reporting that impacts how secondary investments are valued and presented to investors. Compliance with these rules requires sophisticated systems and processes that many secondary investors are still developing.

Cross-border regulatory coordination has become increasingly important as secondary transactions often involve investors and assets across multiple jurisdictions. Regulatory arbitrage opportunities have decreased as international coordination has improved, but compliance complexity has increased correspondingly. Secondary investors must navigate varying regulatory requirements while maintaining consistent valuation and risk management practices.

Anti-money laundering (AML) and know-your-customer (KYC) requirements have been enhanced for secondary transactions, particularly those involving foreign investors or complex fund structures. These requirements can impact transaction timing and costs, factors that sophisticated secondary investors incorporate into their valuation models and transaction structuring decisions.

Tax optimization remains an important consideration in secondary valuation, particularly for transactions involving tax-exempt investors or those structured across multiple jurisdictions. Changes in international tax treaties and domestic tax legislation can significantly impact the after-tax returns of secondary investments, requiring regular updates to valuation models and transaction structures.

Emerging Regulatory Trends

Looking ahead, regulatory trends suggest continued focus on transparency, investor protection, and systemic risk management in the private equity secondaries market. Proposed regulations around climate risk disclosure, cybersecurity requirements, and operational resilience standards may create additional compliance obligations but also provide new sources of valuation-relevant information for secondary investors.

Frequently Asked Questions

What is the typical discount rate range for private equity secondaries in 2025?

Discount rates for private equity secondaries in 2025 vary significantly based on fund quality, vintage year, and market conditions. Top-tier buyout funds typically trade at 5-15% discounts to NAV, while venture capital and growth equity funds may command premiums of 5-20%. Market volatility and interest rate environments can cause these ranges to fluctuate considerably, making real-time market analysis essential for accurate pricing.

How do GP-led secondary transactions differ in valuation from traditional LP secondaries?

GP-led secondary transactions require distinct valuation approaches due to their structural complexity. Unlike traditional LP secondaries that involve purchasing existing fund interests, GP-led deals often feature continuation funds with extended hold periods, modified fee structures, and asset selection bias. These factors require specialized DCF models, alignment analysis, and consideration of the GP's value creation thesis, often resulting in different risk-return profiles than traditional secondary investments.

What role does ESG play in private equity secondaries valuation?

ESG factors have become integral to secondaries valuation, particularly in European markets with stringent regulatory requirements. Companies with strong ESG profiles often command premium valuations due to reduced regulatory risk, improved access to capital, and enhanced long-term sustainability. UN PRI research indicates that ESG considerations can impact returns by 10-15% over investment hold periods, making ESG analysis essential for accurate valuation.

How has technology improved private equity secondaries valuation accuracy?

Technology has revolutionized secondaries valuation through improved data analytics, real-time monitoring capabilities, and enhanced forecasting models. Machine learning algorithms now process vast amounts of alternative data sources, while blockchain technology promises improved transaction transparency. These technological advances have reduced valuation uncertainty and enabled more frequent portfolio updates, though they require significant investment in systems and expertise to implement effectively.

What are the key regulatory changes affecting secondaries valuation in 2025?

Key regulatory changes in 2025 include enhanced SEC reporting requirements for private funds, updated European AIFMD transparency rules, and refined fair value accounting standards. These regulations have improved market transparency and standardized reporting practices, but also increased compliance costs and operational complexity. Secondary investors must navigate these requirements while maintaining competitive valuation and investment processes, often requiring significant system and process upgrades.

Conclusion: Mastering Private Equity Secondaries Valuation for Success

Private equity secondaries valuation has evolved into a sophisticated discipline requiring deep market knowledge, advanced analytical capabilities, and comprehensive understanding of regulatory requirements. As the secondaries market continues to mature and expand, mastering these valuation methodologies becomes essential for investment success and competitive differentiation.

The key to effective secondaries valuation lies in combining traditional NAV-based analysis with emerging technologies, ESG considerations, and sophisticated risk assessment frameworks. Successful secondary investors employ multiple valuation approaches, maintain robust data analytics capabilities, and continuously adapt their methodologies to changing market conditions and regulatory requirements.

Looking ahead, the integration of artificial intelligence, alternative data sources, and real-time monitoring capabilities will continue to enhance valuation accuracy and efficiency. However, the fundamental principles of thorough due diligence, comprehensive risk assessment, and alignment analysis remain critical to successful secondary investing.

For institutional investors seeking to access these opportunities, partnering with experienced secondary specialists or utilizing sophisticated fund structures can provide access to these advanced valuation capabilities. The complexity of modern secondaries valuation makes professional expertise and institutional-quality processes essential for optimal investment outcomes.

Start exploring secondary investment opportunities today by reviewing the sophisticated strategies employed by leading market participants and considering how these valuation best practices can enhance your investment approach. The private equity secondaries market offers compelling opportunities for those with the knowledge and capabilities to navigate its complexities effectively.