The unprecedented rate of growth in private markets is helping to finance companies, infrastructure, and innovation throughout their growth. Many investors—especially in the private wealth category—remain under-allocated to these asset classes despite their growing relevance. But with changing economic dynamics and new investment structures opening private markets, it's time to reconsider their place in a well-diversified portfolio.

The Expanding Role of Private Markets

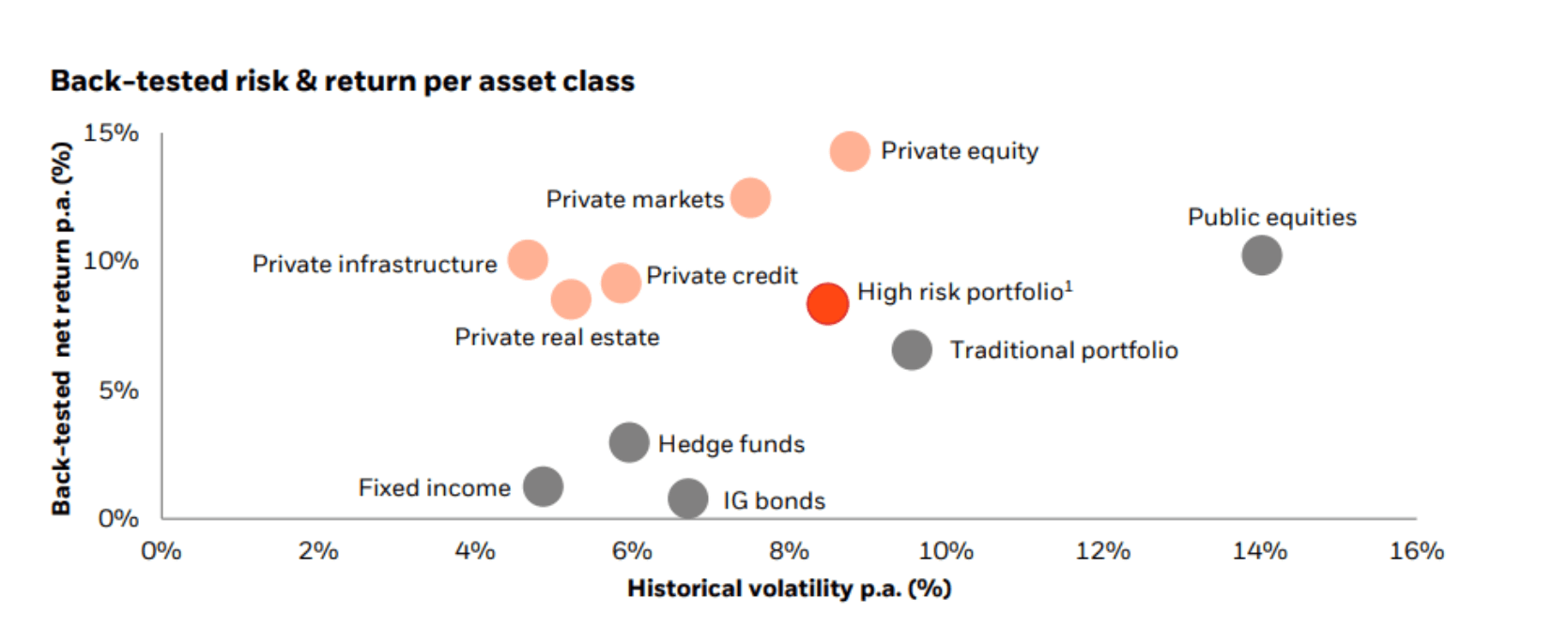

Private markets have evolved over the last few decades into a fundamental engine of the global economy. As companies remain private longer and the number of IPOs declines, investors seeking exposure to high-growth companies are turning more and more to private equity. Private infrastructure and real estate continue to attract long-term investments for consistent, inflation-protected returns while private credit has grown as a flexible alternative to traditional financing.

Private markets historically belonged to institutional investors who could navigate their complexity—including illiquidity, large minimum investments, and complicated structures—through their capacity. But new concepts like semi-liquid and evergreen funds are closing the accessibility gap and allowing wealth managers and high-net-worth individuals to incorporate private markets into their portfolios.

Source: Partners Group 2024

Why Every Portfolio Should Include Private Markets

1. Greater Potential Returns

Over extended investing horizons, private equity has often outperformed public equities. Additionally, many private credit options offer more attractive risk-adjusted yields than conventional fixed income.

2. Diversification Benefits

Private markets have traditionally shown lower correlations with public markets, thereby helping to reduce portfolio volatility and increase overall risk-adjusted returns.

3. Access to a Broader Economy

Private enterprises account for many of the most innovative and fastest-growing businesses worldwide. Private markets provide direct access to these opportunities before they become publicly available, if they ever do.

4. Long-Term Value Creation

Unlike public markets, where quarterly results and short-term pressures guide decisions, private market investors work with longer time horizons. This enables deeper value creation and operational improvements that help drive steady growth.

5. Inflation Protection

Private infrastructure and real estate investments are excellent hedges in uncertain economic times since they often generate consistent cash flows linked with inflation.

Closing the Private Markets Allocation Gap

Despite their clear benefits, private markets remain underrepresented in most portfolios—especially those of private wealth investors. Although structural challenges including lack of liquidity, transparency, and complexity have traditionally held them back, surveys show that financial advisers desire to expose their clients more to these opportunities.

New concepts are emerging to close this gap. Wealth managers and individual investors can now more easily gain exposure in a fashion that fits their liquidity requirements and investment objectives thanks to evergreen structures, multi-asset private market funds, and technology-driven platforms.

Looking Ahead

Private markets are no longer a specialist investment; they constitute a fundamental pillar of capital markets as their assets are projected to reach $30 trillion by the early 2030s. Those who neglect to incorporate them risk missing out on some of the most attractive opportunities for diversification and growth.

The investment landscape is changing, and portfolios must evolve with it. Now is the time to reconsider private market allocation, not in the future.